TABLE OF CONTENTS

- 1. Historical Overview of Gambling Laws in the UK

- 2. Current Updates in Gambling Laws in the UK

- 3. Different Types of UK Gambling Licenses?

- 4. Checklist for Obtaining a UKGC License For Legal Gambling in the UK

- 5. Finances and Taxation for Gambling in the UK

- 6. Steps to Apply for a UKGC Gambling License

- 7. Know How Gammastack Can Help You With Gambling Laws in the UK for Successful Business

- 8. Frequently Asked Questions(FAQs)

The United Kingdom is claimed to be the second largest hot spot of Gambling in the world and most of the revenue is generated in the UK market. With that, the regulatory bodies are bound to necessitate laws concerning gambling for legal play. You must gain insights into the issued gambling laws in the UK by the authorities so that business aims can be achieved.

This is your guide to navigating the regulatory frameworks, the UK’s Gambling market overview, and the checklist for obtaining the required permit and licenses, fueling the non-risky gambling business.

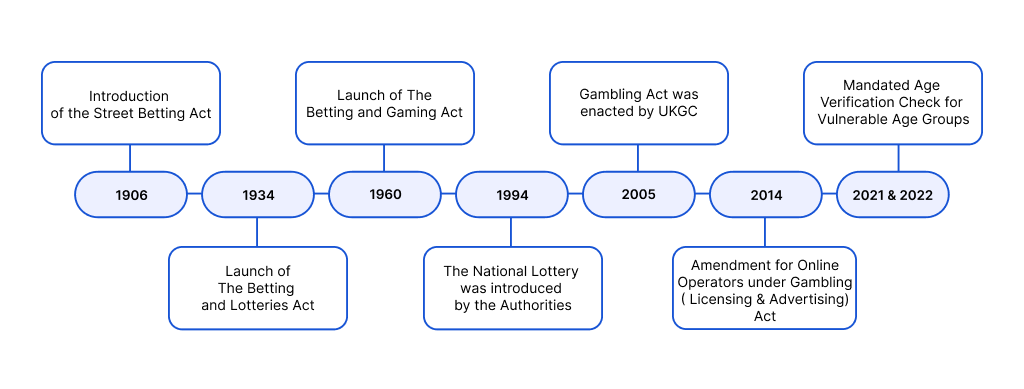

Historical Overview of Gambling Laws in the UK

Gambling has been around in the UK since the 17th century. There were plenty of common games in the city streets and card games, dice games, lotteries, etc were commonly played.

In 1906, The Street Betting Act was introduced to address the negative impacts of gambling, considering it a criminal offence. However, even this act couldn’t prevent betting still prevailing illegally in the local shops and spots secretly.

The government noticed it and found a way to cope with it by introducing the Betting and Lotteries Act of 1934 as well as the Betting and Gaming Act of 1960, legalising the betting shops, casinos and other betting games, followed by strict laws.

Later in 1994, the introduction of the National Lottery was another notable move by the laws enforcing bodies, marking the complete regulation along with the lottery, leading to mass participation.

Finally, in 2005, the United Kingdom Gambling Commission (UKGC) regulated the entire industry under The Gambling Act. Following this, later in 2014, they made it important for gambling operators to obtain a UKGC license from the commission to offer gambling services to UK residents.

There were then the regulations imposed for online operators in 2014 under the Gambling (Licensing & Advertising) Act, along with the introduction of age verification measures to safeguard vulnerable groups in 2020 and 2021.

Current Updates in Gambling Laws in the UK

Currently, UK gambling laws have regulated gambling entirely for operators as well as players; however, they follow the proper guidelines and licenses required by the UKGC for its operation.

As per the latest reports, there were a few updates introduced recently:

- The government announced that there will be limitations imposed on stake limits for the online slots.

- UKGC announced that there will be strict conduction of vulnerability checks, following the conclusion of its summer 2023 consultation process.

- From May 1st 2025, operators shall only conduct direct marketing after obtaining consent on a per-product and channel basis. Also, the advertising regulations have been asked to follow, ensuring the customers are updated concerning the potential associated risks for complete awareness.

These are the few laws that will effectively be imposed as per the UKGC’s decided time frame and will have to be followed by all.

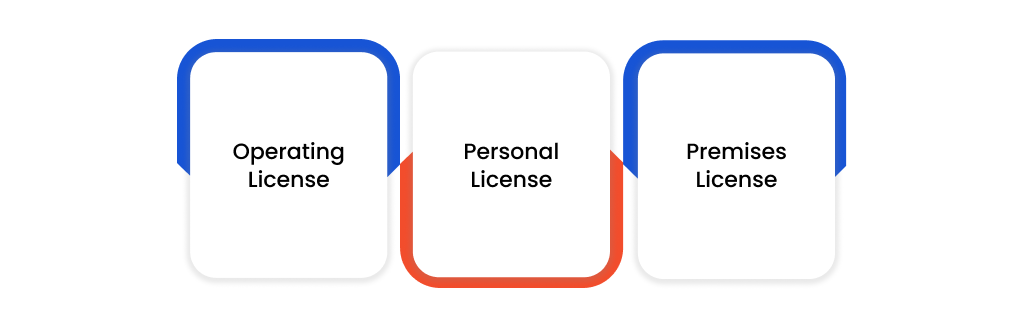

Different Types of UK Gambling Licenses?

Operating License

The operating license is for businesses or operators who want to provide gambling services and facilities to the people, such as casinos, slots, bingo and more.

Personal License

Personal license is to be acquired by those who are operating as well as managing the gambling offerings under the operating license. It is not mandatory for small size business operators however, it strictly applies to large gambling service operators.

Premises License

A premises license is for those who are acquiring a permit for a premises, which they will utilize for single gambling operations such as betting, casino, bingo and more.

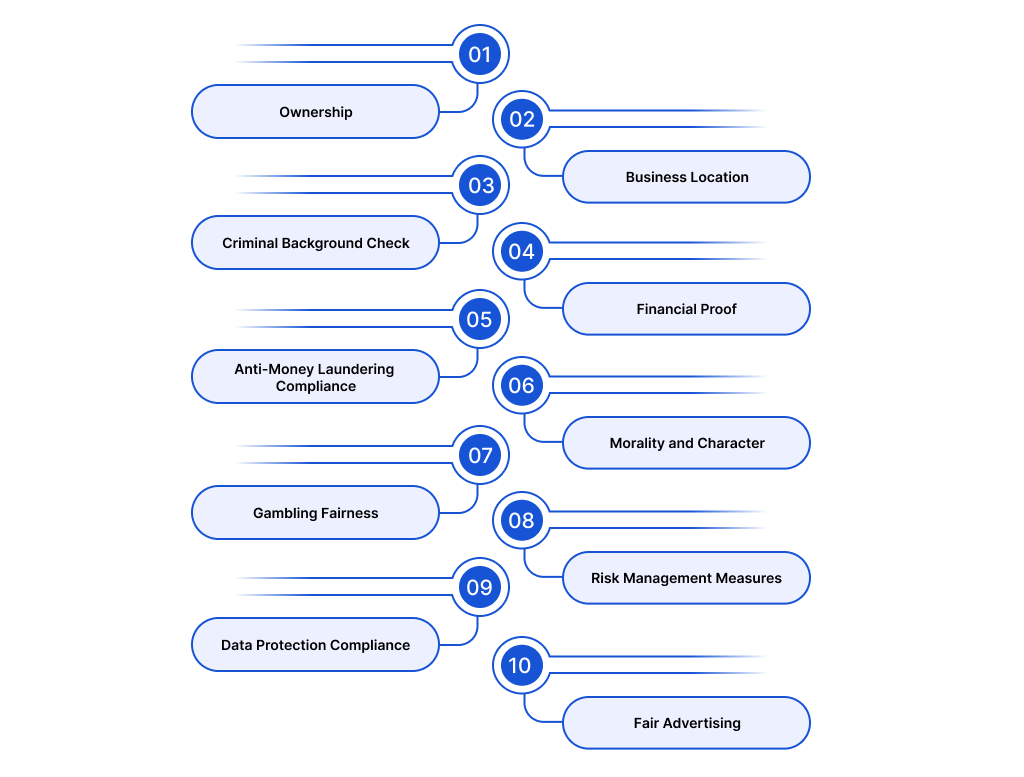

Checklist for Obtaining a UKGC License For Legal Gambling in the UK

Ownership

Operators must obtain clear and concise information about the ownership and identification of the owner.

Business Location

The license must be obtained when setting up a UK-based gambling business.

Criminal Background Check

A thorough criminal check against the company is a requirement for increased safety.

Financial Proof

A financial track record reflecting the funds in the account as well as the financial integrity is necessary for obtaining the UKGC license.

Anti-Money Laundering Compliance

The operator needs to have AML compliance to ensure that no money laundering or terrorist funding-associated activity is carried out.

Morality and Character

It is required to ensure there are no violations in the past cornering the gambling.

Gambling Fairness

Fair play and results are what mark the reliability of online gambling, and it is necessary for the operator to have them in place.

Risk Management Measures

This is indeed the most important tool which the operator needs to incorporate as one cannot obtain a license without it.

Data Protection Compliance

Adherence to data protection and safety is a requirement for secure gambling and safe transactions.

Fair Advertising

When advertising it is required to fairly put all the true information concerning risks out there so there are no false claims concerning gambling.

Finances and Taxation for Gambling in the UK

Operating license holders are required to pay the annual fee to keep the license. As per the Gambling Act 2005, the operator must pay the annual fee before their renewal date. Remote gaming duty of 21% is required to be paid by the gambling platforms.

Gambling Winnings are not taxed in the case of casual gamblers in the United Kingdom for either Land-based gambling or online gambling as the UKGC doesn’t consider gambling winnings as the source of their income.

For professional gamblers as well as gambling operators gambling is subjected to taxation as these are considered under business profits. In that case, the taxes are levied on them ranging between 20% to 45% of the total income earned.

Steps to Apply for a UKGC Gambling License

- Ensure that you have obtained clarity on all required business checks concerning the identity, ownership and integrity of the business.

- Submit all the required documents to the UKGC consisting of the details on business operations including the games you are offering as well as the protection tools for players.

- Make the payment for the licensing fee which is required to be paid at the time of application submission.

- Proof the software compliance as well as the fairness of the game which aligns well with the UKGC standards.

- This is when operators wait for feedback or approval concerning the confirmation of the acceptance of your application. During this time, the operators are required to send a few informational details, required for them to run a check to issue the license.

Know How Gammastack Can Help You With Gambling Laws in the UK for Successful Business

Gammastack is a leading iGaming solutions and service provider with more than 13+ years of experience in the industry.

We specialize in offering best-in-class gambling solutions to global operators and we also offer complete licensing assistance to our valued customers. Our teams of professional consultants offer you complete insights and assistance that you need to obtain the gambling license to launch your online gambling platform in the UK.

Frequently Asked Questions(FAQs)

Yes, Gambling has been regulated and is a legal practice now in the UK, however, to launch your online gambling business, important licenses and permits are required to be obtained along with the legally issued guidelines. If any business fails to adhere to these regulations, they will be charged under offence with penalties.

Yes, without obtaining a license from the United Kingdom Gambling Commission you cannot operate your business or serve the residents of the UK.

No, there are no taxes for the players, however, the gambling operators are subjected to taxes which vary depending on their service offerings.

A player needs to be at the age of 18 or older to enter the gambling as per UKGC guidelines. It is to safeguard the younger people from entering the industry, which involves probable and security risks.

The United Kingdom Gambling Commission is the main body behind the Gambling regulation in the UK. Other authorities include the Financial Conduct Authority (FCA) and Advertising Standards Authority (ASA).

Rising Star Award

Rising Star Award

Premium Usability Award

Premium Usability Award